Saudi Energy Minister Abdulaziz bin Salman put oil bears on notice last week by hinting at OPEC+ production cuts.

The oil market has become schizophrenic, with the paper trade disconnected from physical fundamentals, ABS said in a written response to questions from Bloomberg.

Without spelling it out as such, the minister suggested the possibility of the OPEC/non-OPEC alliance contemplating production cuts. A handful of fellow OPEC ministers came out in support of the idea in the following days.

Brent futures, which had begun free-falling towards $90 at the start of the week, reversed course to settle at a three-and-a-half-week high above $101 on Wednesday, though they had pared some of the gains by the close of the week.

ABS’ jawboning may have been just what a swooning market needed to steady itself amid a state of jitters and volatility amplified by thin trading volumes.

OPEC ministers, officials, and kingpin Saudi Arabia routinely dismiss the idea of the producers’ group chasing price targets.

But it’s no secret that the bloc keeps a close watch on crude prices and factors in current and projected levels into its policy decisions.

At an individual level, oil export-dependent economies have a breakeven budget price for crude, apart from a pain threshold based on their average production costs.

But a renewed OPEC+ output reduction at this stage, just when all the Covid cuts have been unwound, raises a few questions.

An important one among them is, what would be the criteria to trigger such a move, other than Brent threatening to slip below $90?

The OPEC+ ministers are due to meet on Sep 5 to decide October production policy.

Unless the Iran nuclear deal fructifies before then and sends crude prices sharply lower from current levels, we don’t expect an agreement to reduce output.

NUCLEAR DEAL REMAINS ELUSIVE

The oh-so-close but still beyond-reach Iran nuclear accord continued is continuing to keep the oil market on tenterhooks.

As we said last week, the oil market initially got ahead of itself in starting to price in a deal before the i’s had been dotted and the t’s crossed.

With the matter hanging fire for a second week after Iran’s August 15 response to the European Union’s “final draft” proposal, the market began recalibrating to the view that a deal may not be imminent and may not even fructify, despite the recent swell of optimism.

Our view of the current state of affairs, in a nutshell, is that the European Union, brokering hard for a rapprochement, is desperate to get the additional Iranian barrels flowing ahead of its December 5 ban on seaborne imports of Russian crude.

The US may be predisposed to nailing the pact at this point in the face of heightened worries over inflationary pressures on the economy, while for Iran, it is as good a time as any to clinch it.

But neither side may want to easily relent on the sticking points that still remain, which means that what the EU hopefully labeled as a “final draft” may need additional time and work. Also, if the differences cannot be bridged, the deal may fall through again.

ADDITIONAL IRAN SUPPLY WOULD CHANGE THE CALCULUS

The OPEC+ technical committee, which convened before the ministerial meeting earlier this month, forecasted an average global oil surplus of 800,000 b/d in 2022.

Any addition of Iranian barrels will change the calculus on how much demand the remaining members see for their crude in the coming months.

If an Iran accord crystallises or is put on the back burner by September 5, the alliance’s decision could become easier.

In the event of a deal, the ministers could decide whether they need to make cutbacks, depending on how much incremental Iranian oil is expected to flow into the market and how crude prices react to the news.

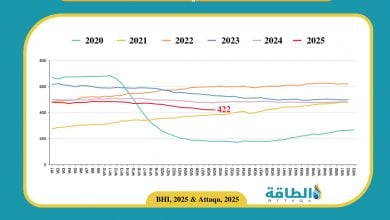

We said last week that going by Iran’s peak production in 2018 before it was hit by a unilateral US withdrawal from the Joint Comprehensive Plan of Action or JCPOA pact and its current output of around 2.56 million b/d, the country could boost output by around 1.3 million b/d.

Iran is also said to be holding around 100 million barrels of crude and condensate in storage, which means it could ratchet up exports much faster.

However, the US may want to initially place limits on Iran’s oil exports as leverage to ensure Tehran abides by its commitments under the revived JCPOA.

All the main parties involved in the latest efforts — the US, the EU and Iran — have closely guarded the contents of the proposed blueprint, but some Iranian media reports last week said the plan was to allow Tehran to export 50 million barrels over the first 120 days of the agreement.

The figures translate to an average of just under 417,000 b/d of oil that Iran would be able to export over the first four months of the deal.

If the true, the volume may not exert too big a pressure on crude prices in the event of a deal, alleviating the pressure on OPEC+ to respond with cuts.

The writer is Founder and CEO of Vanda Insights, which provides macro-analysis of the global oil markets.

READ MORE...

- The fanciful goals of Green New Deal are nowhere in sight (Article)

- oil prices continues to be led by daily shifts in mood (Article)

- OPEC+ turns protective of limited spare capacity (Article)

- Russian Invasion of Ukraine accelerates higher fuel and electricity prices (Article)

- The Iranian gas dues problem and resupplying Iraq and Turkey (Article)