Crude prices got a lift last week from an optimistic turn in sentiment in the broader financial markets prompted by data showing US inflation easing in July.

But unlike major benchmark US and European stock market indexes, which remained buoyant into the end of the week, the upward thrust in crude had reversed by Friday.

All in, while the crude complex continues to be largely led by day-to-day shifts in mood over the global economic outlook while market fundamentals remain in the wings, it is not always fully in sync with the equity markets or other risk assets.

With economists cautioning that it was too soon to say whether US inflation had bottomed out and it was likely a “bear market rally” in stocks last week, crude’s pullback on Friday may have been more in tune with the economic realities facing the world.

ICE Brent as well as CME WTI futures recorded weekly gains of 3.4-3.5% by settling at $98.15 and $92.09 respectively on Friday, but were still 23% and 26% below their March 8 peaks.

Inflation implications

Consumer Price Inflation in the US decelerated to an annual growth of 8.5% in July from 9.1% in June, thanks to a significant drop in energy costs, the Labor Department reported on Wednesday. It was unchanged month-on-month.

Producer Price Inflation, which tracks changes in prices that businesses charge each other, was up 9.8% on year but down 0.5% from June.

The significant cooling in price pressures kindled hope that the US Federal Reserve may be able to ease off on its accelerated pace of interest rate hikes.

However, economists pointed out that inflation, still close to decade-highs, is well above the Fed’s 2% target. Core CPI, which excludes food and energy costs, was 5.9% higher on-year in July. The US central bank, which moved aggressively with two back-to-back rate hikes of 75 basis points each in June and July, is unlikely to shift gears yet, making sure that inflation is really quashed, according to economists. The Fed’s next policy meeting is due over September 20-21.

What have crude prices got to do with inflation expectations and Fed rate hikes? Nothing directly, but with current global oil supply and demand balances remaining largely stable, the outlook for oil consumption in the coming months, which in turn shifts with an ongoing recalibration of the timing and extent of a global economic downturn, dominates sentiment.

Demand conundrum

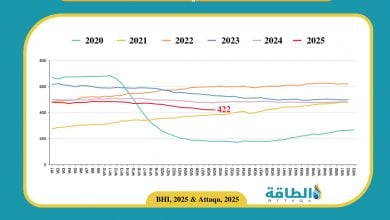

The growing divergence in global oil demand expectations of OPEC and the International Energy Agency in their latest monthly reports last week underscored the growing unpredictability over the future trajectory of consumption that is roiling the market.

The IEA upgraded its 2022 global oil demand projection to an average of 99.70 million b/d, up about 520,000 b/d from last month’s forecast. It raised estimated annual demand growth for this year by 380,000 b/d to 2.1 million b/d. The Paris-based energy policy advisor to the OECD countries said that that “soaring” oil use for power generation and gas-to-oil switching were boosting demand, with the gains masking relative weakness in other sectors.

A spike in natural gas and electricity prices, combined with heatwaves in many regions, were incentivising gas-to-oil switching, especially in Europe and the Middle East, and parts of Asia, the agency said.

OPEC, in contrast, cut its global oil demand forecast for 2022 by 260,000 b/d from last month’s estimates to 100.03 million b/d, with the downgrade concentrated in the second half of the year. The producers’ group cited “a resurgence of Covid-19 restrictions and ongoing geopolitical uncertainties.”

Notably, OPEC slashed its demand projections for the current quarter by 720,000 b/d to 99.93 million b/d, revising down the expected need for its crude by 1.24 million b/d to 28.27 million b/d, which is about 570,000 b/d below what the group pumped in July.

The EIA, in its monthly report released this week, trimmed its expected 2022 annual global oil demand growth to 2.10 million b/d from the 2.26 million b/d estimated last month, to 99.44 million b/d.

Despite its souring demand view, OPEC, with its estimated annual global growth of 3.11 million b/d in 2022, remains the most optimistic of the three closely-watched monthly forecasts in the oil market. It is the only one projecting global oil consumption surpassing 100 million b/d in 2022, though with the latest revision, it joins the EIA and the IEA in expecting a third consecutive year of demand remaining below pre-Covid levels.

EIA under fire

The US EIA has come in for unusually strong criticism in recent weeks over the veracity of its domestic gasoline sales data, including conspiracy theories that the government agency is deliberately under-reporting consumption in a bid to push benchmark WTI prices down.

EIA data last Wednesday showed implied gasoline demand in the US jumping to 9.12 million b/d in the week to August 5 from 8.54 million b/d the week before. Big weekly fluctuations can be misleading for those looking to gauge short- to medium-term trends, so market participants often focus on the four-week averages. But given the persistent softness in the EIA’s gasoline numbers since the start of July, even the latest four-week average, at 8.86 million b/d, stood 6% below year-ago levels.

High prices at the pump are believed to have crimped gasoline use in the US, but market players are incredulous that consumption of the fuel in the midst of the country’s peak summer driving season could be languishing substantially below year-ago levels.

The doubts and criticism first erupted in early August, when the EIA reported 8.54 million b/d of gasoline use for the week to July 29, a whopping 13% below the corresponding week of 2021 and – unbelievably for many -- 1% below the same period of 2020, when the country was under strict and widespread Covid restrictions.

Reputable agencies that collect sales data from petrol pumps — as opposed to the EIA, which tallies “implied demand” based on the volume of fuel leaving storage sites — have been reporting much stronger gasoline demand than suggested by the official data.

The US, with a daily consumption of approximately 20 million barrels of oil, represents nearly 20% of global demand.

Its gasoline use alone accounts for about 9% of the world’s fuel consumption.

US demand trends and changes in commercial oil inventories, observable in the most promptly, frequently, and transparently released official data of any major consuming country, is often also viewed as a proxy for the western OECD world, which amplifies its impact on market sentiment and price movements.

The EIA has so far declined to comment on the controversy. It behoves the agency to double-check its data and make its findings public to set the record straight as quickly as possible.

*Vandana Hari is Founder and CEO of Vanda Insights, which provides macro-analysis of the global oil markets.

READ MORE...

- Are people spoiled by the comforts of affordable and abundant energy? (Article)

- The fanciful goals of Green New Deal are nowhere in sight (Article)

- (Article) The Top 5 Reasons Behind Fruitless Energy Policies